Confluence of Interests: Trump, Ishiba, and LNG

The Trump-Ishiba meeting agenda includes liquefied natural gas. Trump wants to sell more LNG. Japan wants to buy more LNG. What are the potential roadblocks and who will be the losers?

This week, Prime Minister Ishiba Shigeru will travel to Washington for his highly-anticipated first meeting with US President Donald Trump.

While Trump has hardly talked about Japan (he probably didn’t even know the Prime Minister’s name until recently), this visit is vitally important for Japan and for Ishiba’s own political standing.

“We have a lot of topics to discuss,” Ishiba told the Diet. Sure enough, the extensive meeting agenda will include security and defense, China, North Korea, the Taiwan Strait, Nippon Steel, semiconductors, trade, a free and open Indo-Pacific…

Less talked about in the US press but definitely on the forefront of Japanese leaders as they visit the White House is energy. Specifically, liquefied natural gas (LNG). More specifically, to test the waters on whether Japan can import more LNG from the US.

There is a clear confluence of interests here. The Trump Administration wants to increase oil and gas production and, presumably, LNG exports. Japan plans to rely on gas for a sizable chunk of its energy mix domestically for the long-haul and has ambitions to become a regional LNG hub. While the US hasn’t been a major source of LNG for Japan, its role is very likely to grow after Ishiba’s visit to Washington this week.

This strengthened LNG partnership isn’t without a few bumps in the road. Competing demand between US domestic consumption and exports, the high cost of the new Alaskan LNG project, and competing demand from Europe can become slight sticking points. But I don’t think these factors will seriously get in the way of Japan importing more LNG from the US.

Who will lose from this partnership? By becoming a competing source of demand for increased American LNG, Japan might contribute to higher energy prices in the US. And given that Japanese energy companies are aiming to become LNG re-sellers in the Southeast Asian markets, this deal would further jeopardize the clean energy transition and climate change mitigation in the region.

American Interests: “Unleashing American Energy”

That’s the title of one of the executive orders that Trump signed on Day One of his second presidency. Following through with his “drill, baby, drill” rhetoric, the executive order encourages domestic energy exploration and production (yup, that means more fossil fuels), lifts the Biden-era ban on LNG exports, and pauses federal funding for clean energy projects.

Although Trump’s sudden announcements of tariffs on Canada, Mexico, and China and the ensuing diplomatic negotiations have ratched up uncertainty among American LNG companies, China’s retaliatory tariff on US LNG is sending the industry to look for more predictable market to sell into. Japanese companies are already signaling that they can provide that stability.

Japanese Interests: LNG as Energy Security, Emission Reduction, Grid Reliability, Regional Influence

LNG occupies a special place in Japan’s energy strategy. Policymakers and energy companies have long framed the fuel as “clean” and perfectly compatible with the government’s carbon neutrality target. They also see LNG as a valuable source of base load power that can ensure grid reliability as the country increases variable renewable energy capacity. And in an energy strategy that prioritizes diversity of supply, a relatively even split of oil, gas, coal, nuclear, and renewables, and well-distributed sources of fuel imports are music to policymakers’ ears.

Global and domestic events in the last several years have amplified LNG’s importance to Japan. The global energy crisis triggered by Russia’s invasion of Ukraine and the growing electricity demand thanks to AI, data centers, and semiconductor manufacturing have made securing stable supply from overseas all the more pressing. While the 7th Strategic Energy Plan doesn’t disaggregate each fossil fuel in its outlook for 2040, there’s no question that LNG will continue to be a crucial energy source, along with petroleum.

Also adding to Japan’s interest in procuring more LNG is its regional ambition. Specifically, the Japanese government and LNG buyers are aiming to turn Japan into an LNG hub for Asia. Japan’s LNG demand has declined in recent years thanks to a dwindling population. This has prompted a shift in the country’s LNG policy toward becoming a marketer and reseller of LNG. Japanese utilities now actively cultivate demand in emerging Asian markets, competing more directly with global suppliers. This evolving strategy enhances Japan’s influence in the Asia-Pacific energy landscape.

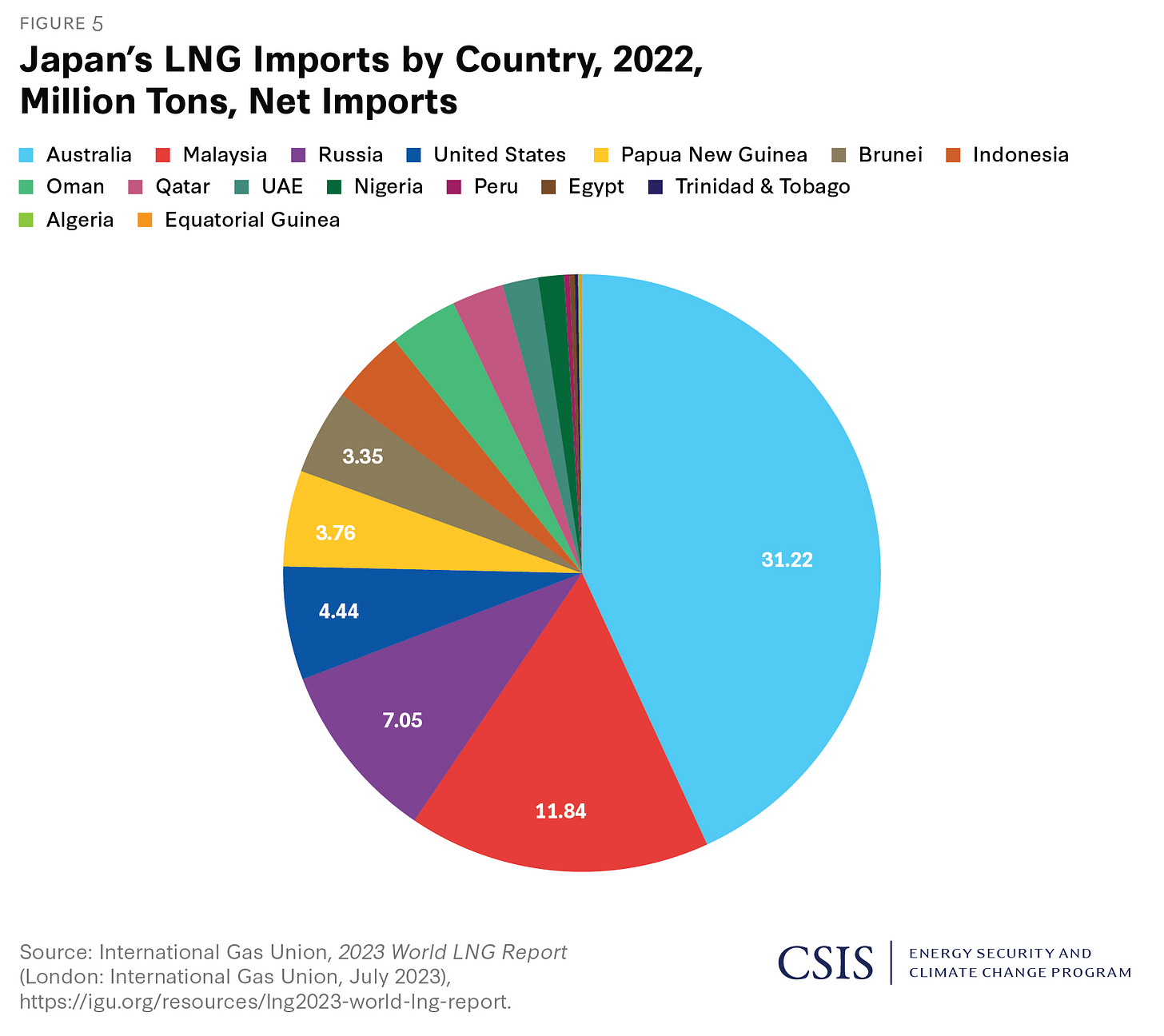

Although imports from the US only accounts a small share of total LNG imports in Japan (Australia, Malaysia, Russia are bigger sources), Japanese LNG buyers are particularly taken by American LNG for several reasons:

According to the Ministry of Finance data (reported by Kyodo News), American LNG is ~10% cheaper than Australia’s.

Known US gas reserves are enormous, thanks to the shale revolution. This provides supply certainty for Japanese buyers. (See page 60 of this report by IEEJ and ERIA)

And of course, there’s the diplomatic reason. Buying more LNG from the US puts Japan in Trump’s good graces (so Japan hopes). This can smooth the path on other issues like tariffs, defense, foreign investments, and who knows what else?

For all of these reasons, Japan’s gas industry has been pressing the Ishiba cabinet to make LNG a top issue in his upcoming meeting with Trump. Uchida Takashi, Chairman of the Japan Gas Association and Tokyo Gas, said at a press conference on Wednesday that “I hope that Japan will be able to produce LNG cheaply and steadily. If [US] production increases, prices will fall … We can expect to see cheap LNG coming into Japan.”

Bumps in the Road

There’s a couple of bumps in the road to this potential LNG trade partnership that should otherwise be smooth. I’d like to caveat this by saying that Trump has an unmatched ability to ramp up the unpredictability of just about everything, so more road bumps may emerge sooner or later.

Alaska LNG

First is the Alaska LNG project. Reuters reported that the Japanese government and businesses are considering offering support for a proposed $44 billion, 800-mile pipeline that would link gas fields in Alaska’s north to a liquefaction and export terminal on the state’s southern coast.

If at all possible, Japan would avoid this investment and purchase agreement. That’s because the capital outlay for building the pipeline and terminal is certain to make LNG from this project more expensive than from other US sources. Japan Gas Association’s Uchida said at the same press conference that “there is a possibility that [President Trump] will ask us to buy Alaska LNG” and that “I hope we will not be forced to pay high prices.”

But Trump is all about the Alaska LNG project, and at least one US Senator from Alaska has been nudging the President to bring up the issue with Ishiba. And Japan is willing to bend over backwards for a warm relationship with Trump. If Trump demands it, Japanese leaders will very likely commit to Alaska LNG, in addition to other concessions like increasing defense spending and manufacturing investment in the US to reduce the $56 billion bilateral trade deficit, according to Reuters. They would do all of this to stave off avert the Trump tariff.

Competition from the EU

Another potential friction is the possible competing demand for US LNG in Europe. US LNG exports to the EU surged after pipe gas from Russia diminished in 2022. In 2023, two-thirds of US LNG exports were directed to Europe, raising concerns that increased European demand could drive up prices.

After Trump won his re-election in November, European Commission president Ursula von der Leyen signaled that Europe could buy more US LNG. The CEO of TotalEnergies floated the idea that the EU negotiate a free trade deal on LNG with the US as a way of guaranteeing that the US won’t unilaterally impose tariffs.

If the EU does commit to buy more US LNG, this may raise the price for Japan. But again, my guess is Japan will still decide to up its import from the US, for diplomatic reasons if nothing else.

The Losers

Japan will consider itself a winner if it increases the share of American LNG in its overall LNG supply, even if it has to pay a higher price. In the eyes of Japan’s political leaders, being on a shoulder-patting basis with Trump, avoiding US tariffs, enhancing energy security by diversifying suppliers, and having extra capacity to resell to Asian markets is worth the sacrifice.

Who would be the losers, then? Very broadly, I think there will be two kinds of losers.

American Gas Consumers

There seem to be plenty of research showing that US LNG exports raise wholesale domestic natural gas prices. A December 2024 study by the US Department of Energy concluded that “unfettered exports of LNG” would raise domestic gas prices by over 30% (wow!), and that “Unconstrained exports of LNG would increase costs for the average American household by well over $100 more per year by 2050.” The US Energy Information Administration agrees, saying that it expects the benchmark natural gas spot price to increase in 2025 and 2026, “driven mainly by more demand from US liquefied natural gas (LNG) export facilities.”

In short, striking deals with Japan and the EU would go directly against Trump’s “unleashing American energy” agenda of reducing energy prices by producing more.

Asia’s Clean Energy Transition

Enabling Japan to increase its surplus LNG would directly undermine the clean energy transition in Asia, particularly South and Southeast Asia.

Wonderful research by the Institute for Energy Economics and Financial Analysis (IEEFA) shows how four of Japan’s largest utilities and LNG buyers (JERA, Tokyo Gas, Osaka Gas, and Kansai Electric) now have surplus LNG on their hands thanks to declining domestic demand for gas. In response, these companies and the government have pivoted to cultivating demand in Asia’s emerging markets.

Emran Hossain also describes in detail how Japan’s electric and gas utilities, JERA, and the Japan International Cooperation Agency (JICA) have played an important role in delaying Southeast Asia’s clean energy transition, in large part by investing in the LNG value chain to offload their own LNG surplus.

Increasing US LNG imports would embolden these actors to continue their resale into South and Southeast Asia, and strengthen their incentive to build out LNG-related infrastructure. Growing LNG and gas-fired power generation would then crowd out the investment for renewable energy that’s truly needed for a clean energy transition.

Of course, we’ll be in a much better position to assess if any of the above transpires after the Trump-Ishiba meeting this week. I’m on the edge of my seat.

I welcome any and all thoughts and questions related to this post. Please leave them in the comments below or in the subscriber chat.

Last but certainly not least, don’t forget to share this post with your friends, family, colleagues, or strangers.

Good essay. An observation: Alaska LNG is unlikely to contribute to US price inflation. The project would be fed by undeveloped fields on the North Slope, rather than drawing gas out of the Lower 48 states. The real danger is from all the Gulf Coast projects in the pipeline sucking gas out of shale plays connected to Henry Hub in Louisiana. Those projects will mostly supply LNG to Europe.