Power Japan Newsletter - Investors Push Japanese Big Business on Climate

Investors just might be the unsung climate heroes

In Japan, investors are doing what the government is refusing to: forcing big business to take real action on climate.

Japan’s largest banks and power companies are facing the heat from shareholders. A growing number of shareholders (individual as well as institutional investors) are backing proposals calling for greater action and transparency on meeting net-zero carbon emissions targets.

At a time when the Japanese government is pushing energy policies that will likely lead to little emissions reduction in return for massive investments, investors are slowly but surely pressing financial, energy and manufacturing conglomerates to think about and act on climate change.

Let’s be specific. What are shareholders calling for?

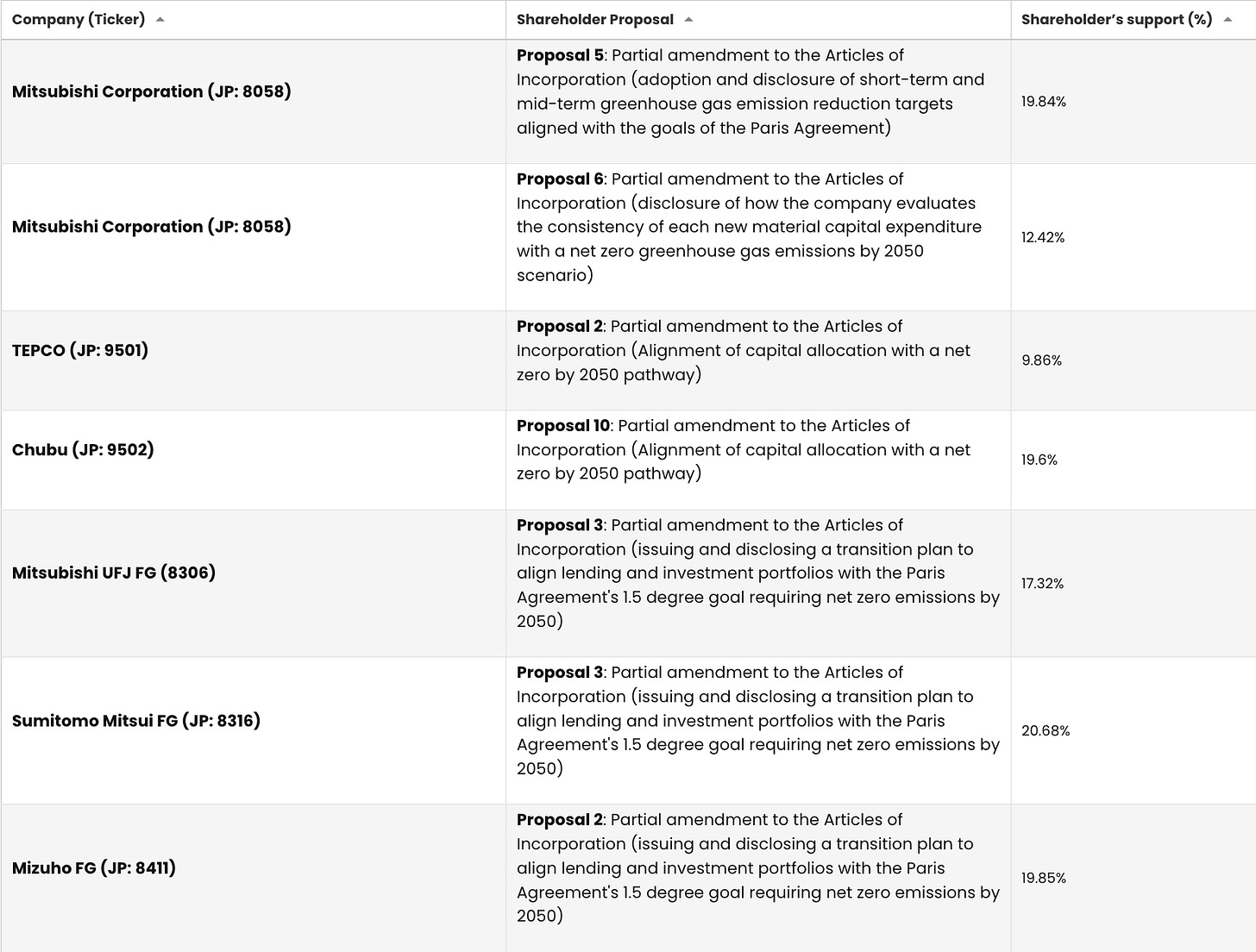

Tokyo Electric Power Company (TEPCO; electric utility ⚡): TEPCO has set a net-zero 2050 target, but it’s not specific enough. TEPCO’s subsidiary JERA is the largest CO2 emitter in Japan, and it’s planning to start commercial operation of new unabated coal power plants in Japan.

At Chubu Electric (electric utility ⚡), like TEPCO, shareholders are unhappy about the company’s 2050 roadmap that lacks feasibility and specificity. The company’s involvement in new fossil fuel projects both in Japan and abroad, as well as its claim that ammonia co-firing is a decarbonization measure just don’t hold any water.

For Mitsubishi Corporation (general trading company 🛠️), nearly 20% of shareholders voted in favor of a proposal requesting that the company disclose its short- and medium-term emission reduction targets aligned with global climate goals.

The “megabanks” 🏦 (as Japan’s 3 largest financial groups Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho are colloquially called) have updated or strengthened their climate-related policies in recent years, but they still lack urgency on the climate crisis and the implications of continuing to finance fossil fuel-related businesses. Shareholders pressed them to craft a transition plan to align their lending and investment portfolios with the Paris Agreement’s 1.5°C goal requiring net-zero emissions by 2050.

Plus, Japan’s Electric Power Development Co (J-Power) was also faced with shareholder resolutions to disclose Paris-aligned emissions reduction targets in May. A similar resolution at J-Power garnered 26% of votes last year.

These resolutions in Japan come on the heels of ESG and climate-related resolutions that corporations in other countries face. American oil and gas companies and electric utilities, for example, faced 59 shareholders resolutions as of March this year, almost all related to the environment and carbon emissions. Shareholders have also pressed big financial institutions like JP Morgan, Wells Fargo, Goldman Sachs, and Bank America to disclose credible climate transition plants.

The growing number of climate-related resolutions and the increasing percentage of favorable votes they garner suggest “patient capital” flexing its muscles 💪🏽: global institutional investors like Amundi, Man Group, HSBC Asset Management and the like are increasingly alarmed about the material impacts of climate risks on their portfolios.

But they also reflect the growing boldness of civil society advocacy organizations. In Japan, it was organizations like Friends of the Earth Japan, Kiko Network, Market Forces, and Rainforest Action Network that submitted those proposals.

(If you’re interested in getting more climate- and energy-related developments in Japan, I highly recommend following these groups 📫)

Are these resolutions succeeding?

If you mean “Do they win a majority of the shareholder votes?” then the answer is clearly no. As you can see, the resolutions listed above are getting around 20% of the votes.

But that’s misses the point. As You Sow explains that many companies try to avoid shareholder votes because they want to project a positive image at their annual shareholder meetings. So the mere act of filing a resolution often leads to a dialogue between shareholders and the management to address shareholders’ concerns. If a resolution is voted on, a majority vote isn’t necessary to convince the executives to take action on sustainability.

Case in point: Market Forces filed a shareholder proposal with Sumitomo Corporation in 2021, garnering 20% vote in favor. But in response, Sumitomo made improvements to their coal policy and announced their withdrawal from the 1.2 GW Matarbari 2 coal power station in Bangladesh in February 2022. That was a huge win‼️

Climate-related resolutions filed with financial institutions are also powerful tools that can force them to pull back from fossil fuel financing. For years, the Japanese megabanks (yes, them☝🏽) have been some of the worst offenders in the world when it comes to financing fossil fuel projects around the world. They feared that divesting from fossil fuels will harm the investment performance of their portfolios, leading them to violate fiduciary duty.

But in reality, these fears are unfounded. Several studies (this and this, for example) found that, even if institutional investors sell their stakes in coal, oil, and gas companies, their portfolio returns did not take a noticeable hit. That also means that fossil fuel divestment does not go against their fiduciary duty 😃

Under tremendous pressure from shareholders, combined with net-zero commitments of governments around the world, these megabanks are taking the plunge into the uncharted territory of suspending financing for coal-fired power plants in South Asia and elsewhere. But worry not; the banks will be fine. In fact, they’ll enjoy the reputational payoff of being less bad 🏅

From my perch, investor pressure is probably the single most powerful lever that can turn Japanese industry away from its obstinate embrace of coal and gas. If it’s not too late, investors might even be the force that can electrify ⚡ (excuse the pun) Japanese manufacturers to vie for leadership in the increasingly competitive global rush for clean energy.

That’s it for this week. Did you like what you read? Subscribe, like, and share the Power Japan Newsletter.

If you have suggestions on news pieces that would be a good fit for this newsletter, don’t hesitate to message me or comment below.

The views expressed on this newsletter/blog are mine alone and do not necessarily reflect the views of my employer.